Nearly Half of Wake County Residents Are Paying Too Much For Housing

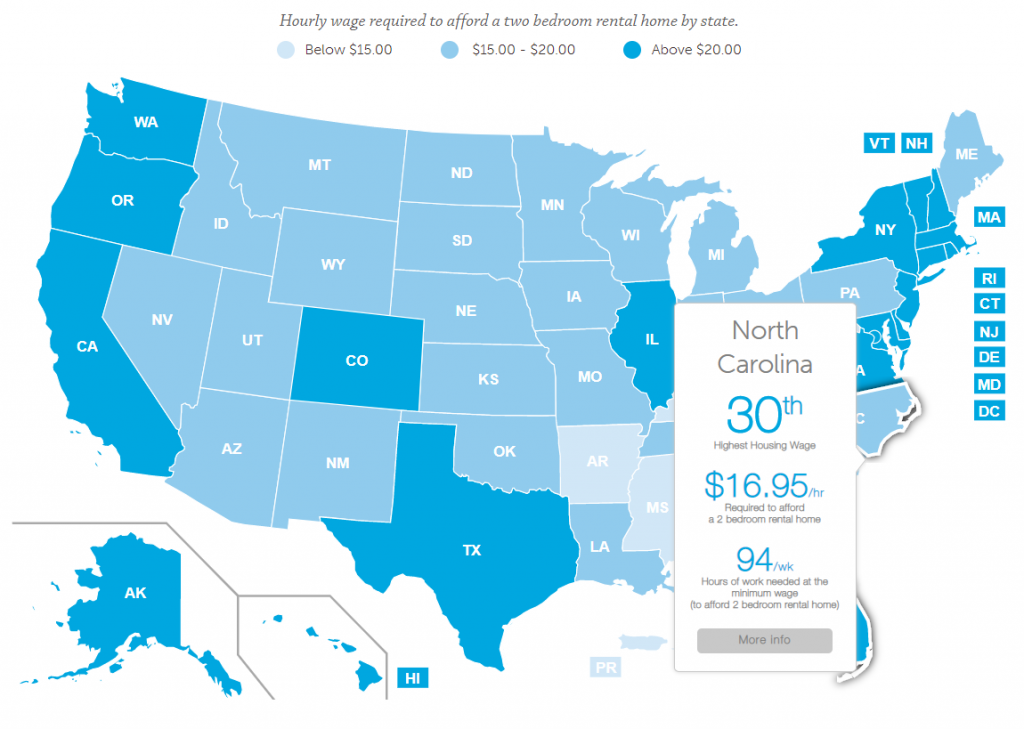

In 2018, the National Low Income Housing Coalition released a report with information that may surprise you: full-time minimum-wage workers can no longer afford to rent a two-bedroom apartment anywhere in the United States. Anywhere.

In fact, they’d need to make $16.95 per hour or work 94 hours per week at minimum wage to afford it in North Carolina. The federal minimum wage is just $7.25.

By many reports, Wake County is thriving. But despite incredible population growth, 37 nationally award-winning magnet schools, and being home to the 2019 James Beard Outstanding Chef award winner (looking at you Ashley Christensen) nearly half of Wake County residents are considered house-burdened. 46.4% of them to be exact.

Living in a rent-burdened household doesn’t just affect your quality of housing. “Rent-burdened households have higher eviction rates, increased financial fragility, and wider use of social safety net programs, compared with other renters and homeowners,” explains this 2018 Pew Charitables Trusts article. “And as housing costs consume a growing share of household income, families must cut back in other areas.”

But what does that look like locally and how can we, as a community, do more to ease the burden of housing costs so that we can create a region free from poverty? United Way of the Greater Triangle explored those questions with four funded nonprofit partners as part of our focus on Wake County this month.

Stay Informed

Sign up to receive email updates from United Way of the Greater Triangle

How Does The Current Job Market Affect Those Who Are House Burdened?

“The cost of living has quadrupled over the last several years, but the wages for the people we serve at StepUp Ministry have not. Many participants served by StepUp currently earn $10-$14 per hour. Depending on what study you are looking at, the living wage for a single adult with one child is $25.08 and a two-parent household with one child is $23.41.

Unfortunately, not many of our families have reached that hourly wage. Therefore, affordable housing for them is hard to find. Many have to work multiple jobs to make ends meet or they are living with family members or are homeless. This causes parents lots of stress. They are stressed because they are fearful they are unable to afford their rent at the end of the month.

Just a few days ago, one of our parents had to have her oldest child drop out of college because she has to work multiple jobs and had no childcare for her children in the evening. She is staying in a hotel and did not want her young girls to be tricked/trapped into sex trafficking. This is just a tip of the iceberg for some of the families at StepUp.

However, when people become involved with StepUp and take advantage of the opportunities we have to offer and learn about the resources in the community, life can change. It is not a fast process. We partner closely with agencies that assist with transportation, home furnishings, and healthcare services all at a minimal cost. Families are able to put more of their household budget toward housing and not towards a car payment, a furniture bill, and high medical costs. There are many community agencies that support families and assist them with moving toward stability.

What can the community do to help? There are multiple things the community can do to help. The people in the community that own businesses can look at increasing their wages. Studies have been done to show that when you are committed to your employees, show that you care and offer incentives and a decent wage, you have less employee turnover. And paying decent wages strengthens local communities and the economy. Another way the community can help is to be sure to vote. The community can get out and vote; elect people to office that will help change policies for people that work full-time, but are still living in poverty by increasing the minimum wage. Vote at the local levels as well as the national levels.”

- Angela Coleman, Adult Program Director, StepUp Ministry

How Can Being House Burdened Affect Homelessness?

“When you talk about cost-burdened households, you are, invariably, talking about low-income households. While it is uncommon for a household earning at or above the area median income to pay more than 30% of their income for rent, those at the other end of the income scale nearly always do.

The difference is even more striking when you consider those who are very low income. Well over half of these households (earning 30% of the AMI or less) pay more than half of their income for rent! We are talking about between 37,000 and 40,000 households in Wake County that are living “on the edge.” They are living under the constant stress of possible housing loss.

The vast majority of families that we work with – families experiencing homelessness – previously had a home of their own. With rising rents and stagnant wages, making ends meet becomes harder and harder and can lead to an eviction. Job loss, a medical issue, a car that broke down – any number of things can reduce a family’s income to the point that they can no longer afford rent. Oftentimes they move in, temporarily, with friends or family. After a time of living doubled up with others, they may end up at a budget motel. If that becomes unaffordable, they may end up in a shelter or in their car – or even camped somewhere.

Families that we work with often find it hard to understand how they got to the point of homelessness. They had been doing everything “right” – keeping a job, keeping the kids in school, keeping the lights on – working hard and doing the best they can – yet still they ended up losing their housing because they couldn’t quite pay the increasing rent and the competition for units is high. If they are evicted, someone else will quickly take their spot.

So I guess our answer to how being housing cost-burdened can affect homelessness is that it increases the likelihood of becoming homeless. As the number of families that pay more for their rent than is considered “affordable” rises, the number of families that will end up eventually losing their homes will also rise. The need to address the affordable housing crisis in our community is great and it is urgent.”

- Lisa Rowe, Executive Director, Families Together

How Can Being House Burdened Affect Mental Health?

“We hear from our patients daily how the burden of costs associated with housing and other basic human needs influences them to view costs that improve their health as luxury items (medications, healthy foods, transportation to appointments, etc.) As a result, financially burdened patients are forced to choose between their health needs and meeting their families’ needs, and they most often choose to forego expenditures for their own healthcare like visits, medications, labs, tests, etc.).

The chronic stress of routinely having to choose against one’s well being is enough to disrupt mental health and these persistently self-defeating decisions leave patients feeling powerless. The resulting impacts often give rise to anxiety and depression among other psychological distresses and mental health illnesses.

It is also common for housing cost-burdened folks to stay in oppressive, distressing environments because they lack the power to go elsewhere. Victims of intimate partner violence often choose to remain in housing with violent partners because of the lack of affordable housing alternatives.

We offer transportation alternatives to allow our patients access to onsite mental healthcare visits in an effort to combat the impacts of cost burdens on patients’ health. We also use programs to help reduce the costs of medications and specialty care, but our efforts do not address the roots of our patients’ housing cost burdens. Relieving folks of the chronic stress of housing costs can help empower them to make decisions to care for themselves which will improve not only their well-being but the well-being of our communities. The community can help by addressing the housing cost burdens that create the stress on the front end and by providing more funding for mental healthcare to address it on the back end.”

- Toby Bonar, Director of Pastoral Care and Counseling, Alliance Medical Ministry

How Can Being House Burdened Exacerbate Food Insecurity?

“Every cost that is too high – and housing is unaffordable for too many – strains the remaining budget and forces difficult choices. Food seldom makes it to the “must pay” list. So, families stretch their dollars, fill up on poor quality food, eat fewer meals and pay the price in growth, education, and illness.

Most families work two or more jobs and pay the bills they must pay to avoid foreclosure or having their electric, heat or water being turned off. They pay for gas to get to those jobs and when the “must pay” bills are paid, they stretch what is left for food and supplement that with a week of healthy food from our client choice pantry.

We simplified intake for our Hunger and Nutrition Program to allow our neighbors in need and our volunteers and create a space to listen to the stories of the too many people who are barely getting by in our community. We make connections with each other and referrals to partner agencies for services Urban Ministries doesn’t provide.”

- Peter Morris, Executive Director, Urban Ministries of Wake County

United Way of the Greater Triangle is committed to funding solutions that address affordable housing, mental health needs, food insecurity, and so much more. Donate now to support these efforts and help create a Greater Triangle free from poverty.